Carbon Pricing: Emissions Trading Systems and a Tax on Carbon

8 minute read

Updated on: 13 Sep 2021

Climate change will result in huge costs for future generations. However, future costs are not normally included in the prices of products or services that contribute to climate change

.

To address this, and to make emission reductions happen, some people suggest that we should put a price on our goods and services that reflect their true cost to society. This is where carbon pricing comes in.

Carbon pricing means businesses that emit carbon dioxide have to pay for those emissions .

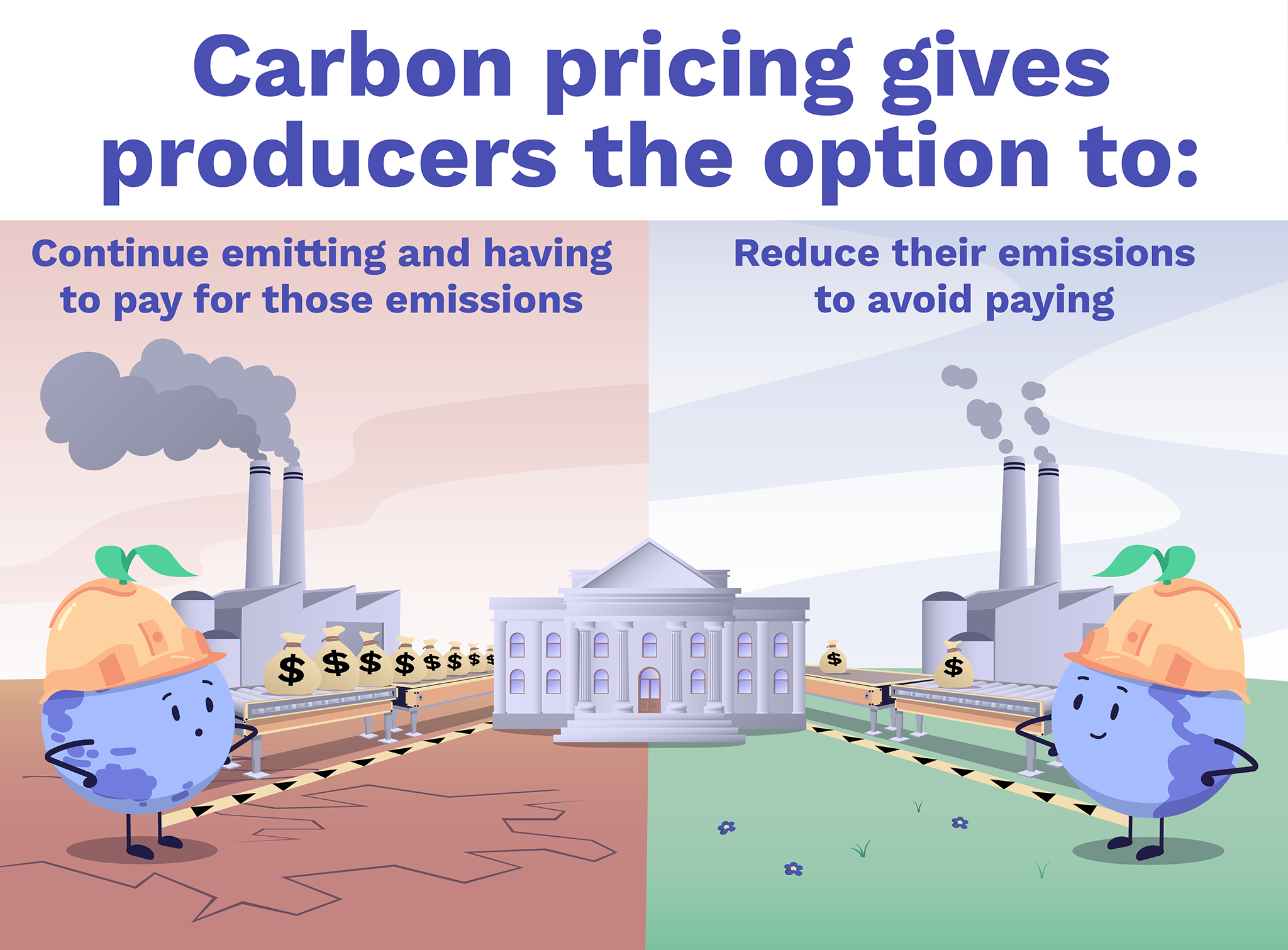

This gives producers of CO₂ two options :

- They can continue emitting as usual and pay up, which increases their costs

- Or, they can find a way to reduce their emissions and then don’t have to pay

The benefits of carbon pricing

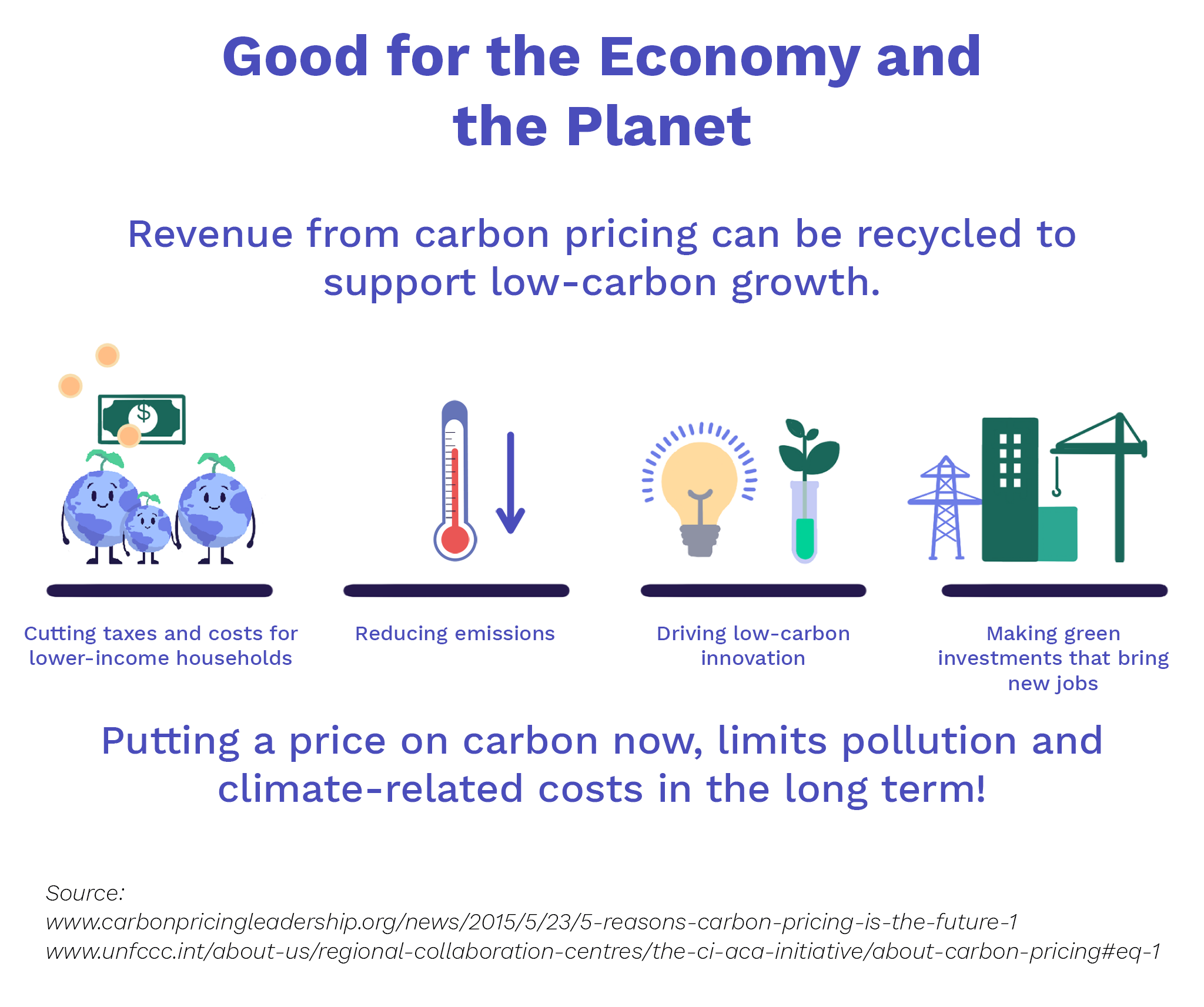

Pricing carbon can encourage investment and innovation into clean technologies. This is because using polluting technology becomes too expensive due to the additional carbon price cost.

Carbon pricing has several benefits

There are two main ways of pricing carbon:

Let’s look at these one by one…

Carbon taxes

A carbon tax directly sets a price on carbon dioxide emissions . This means that companies are charged a set amount of money for every tonne of CO₂ that they emit

.

The province of British Columbia in Canada is well-known for the way it runs its carbon tax.

Energy and transport largely rely on fossil fuels, so would bear the brunt of the carbon tax. But because almost all other sectors need energy and transport too, the tax would affect the entire economy.

As well as decreasing demand for energy, a carbon tax also leads to the substitution of high carbon fuels with cleaner energy sources. This is known as the substitution effect, because individuals substitute more expensive goods for cheaper ones due to the tax

.

Both of these effects can reduce CO₂ emissions. However, we need to think carefully about how to design carbon taxes, because they can have negative effects too

…

Problems with a Carbon Tax

Although a carbon tax guarantees a price on emissions, it cannot guarantee any specific level of CO₂ reductions. This is because we don’t know whether companies will reduce their emissions, or choose to pay the tax instead.

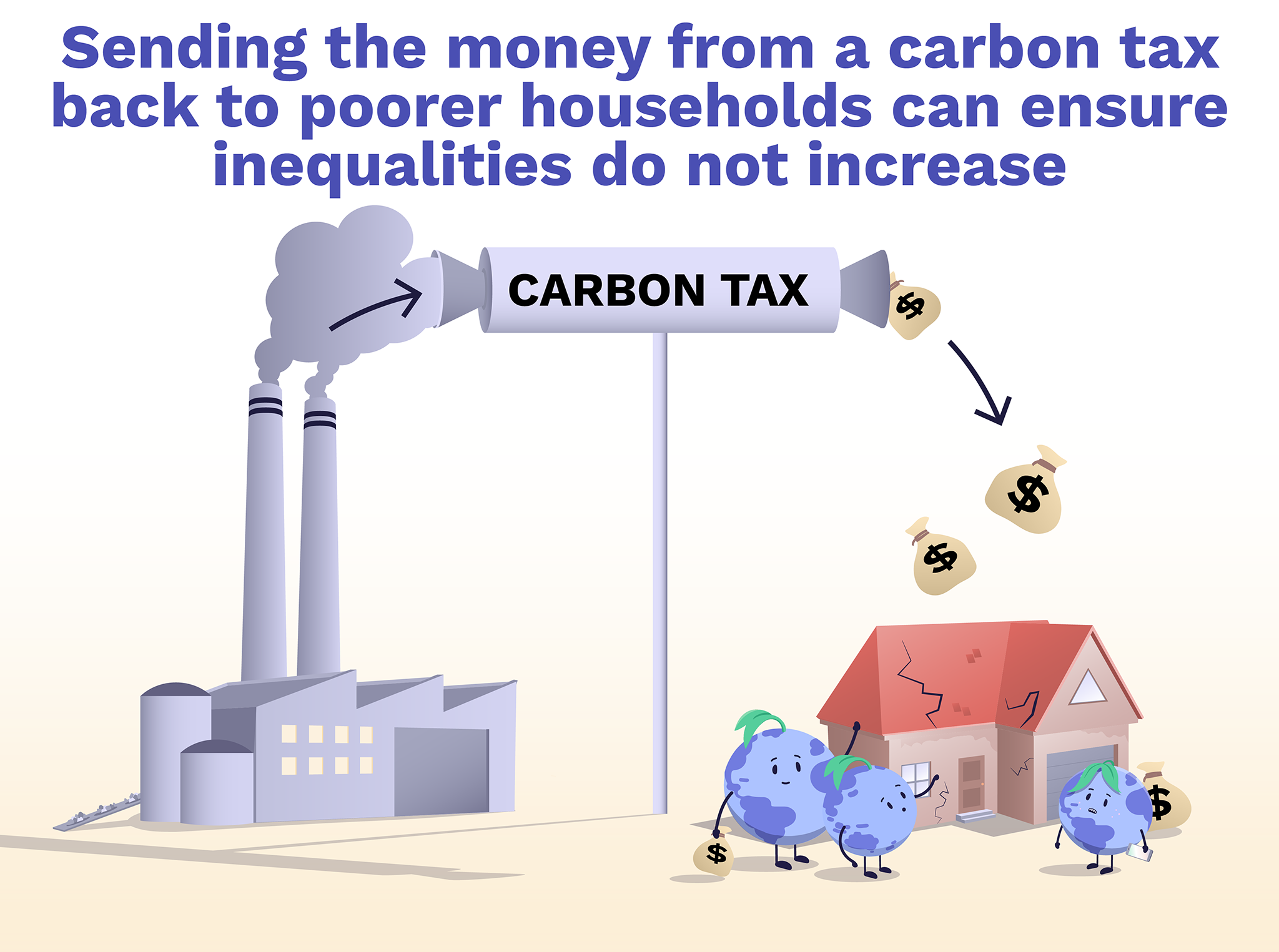

A badly thought-out carbon tax could also make inequality worse, because poorer households have to spend a greater share of their income on heating and energy (which are most affected by the tax) .

Money can be given back to poorer households by direct payments or by cutting other taxes for them . This way, carbon taxes can actually help reduce inequalities that would otherwise be made worse by the tax

. This type of carbon tax is called a revenue-neutral carbon tax.

A revenue-neutral carbon tax

Carbon taxes can be a relatively cheap way to reduce emissions, but their effects will depend on how they are designed. This may need adjusting for different countries, too. So, how else can we put a price on carbon?

Emission trading systems

Emission trading systems

put a limit on the total amount of emissions that can be produced in a certain amount of time.

Companies are then given or sold carbon permits that allow them to release a certain amount of CO₂.

If a company expects to produce more emissions than they have permits for, they have to purchase extra permits from other companies. Companies producing fewer emissions than their permits allow can sell their permits to other companies that emit more

.

The total number of permits available can go down year by year, gradually reducing emissions in line with international agreements .

Emissions trading systems

Unlike the carbon tax, carbon permits do not have a fixed price; instead, they depend on the balance between supply and demand. Supply is the number of ‘carbon permits’ available for sale, while demand is the total emissions being produced. This means that the price can go up and down

.

This changing price of carbon permits might be a problem: if the price is too low, companies can easily buy more permits rather than reducing their emissions.

However, provided the limit is chosen well, an emissions trading system is a good way to make sure that emissions reductions will happen. Unlike the carbon tax, this is guaranteed because of the limit on the number of carbon permits available .

Conclusion

So, carbon pricing is one way to include the cost of CO₂ emissions in our economic system.

However, it is not easy to implement due to the need for companies to accurately monitor and report their emissions. These reports also need checking by another organisation (so companies don’t cheat), all of which needs money and people.

Money raised from carbon pricing should be used to develop clean technologies and to make sure inequality is not increased by the pricing .

As with all the policies we have looked at in this course, a carbon tax will only be part of the solution. We will still need improvements in technology, green investment and plans for emission reductions too. Nonetheless, putting a price on carbon is an efficient way to help achieve targets to reduce emissions

.